All your policy processing needs in one place.

The AgWorks Application Framework is our engine for policy processing. The Application provides company and agent users with the tools they need for quoting existing policyholders and prospects; creating and converting policies; creating and processing claims; keeping in compliance with Company and RMA requirements; accounting and more.

When the AgWorks Application Framework is integrated with our Disconnected Adjuster System and mobile applications, users can enjoy even greater flexibility in their work.

AGWORKS APPLICATION FRAMEWORK VIEWS

SYSTEM COMPONENTS

Overview

As crop insurance products are created to address risks created by both production losses and price volatility, quoting and estimating is essential in helping growers and their agents make better, more-informed risk management decisions to protect their future. With the number of crops, products and coverage options available to policyholders, quoting has become an increasingly complex process—plus, the availability of numerous private products, many designed as add-ons to subsidized products, has only added to the difficulty.

To make quoting easier for agents and equip growers with the right information to choose the best coverage for their specific farming needs, AgWorks created a quoting product: Estimator.

Features

Easily compare coverage scenarios for multiple commodities.

Evaluate different commodities, plans, products, coverages and price level configurations—including add-on coverage options for growers—with just a few clicks of the button. View estimated premium summaries for single- and combined-product coverages (such as MPCI + Named Peril Production Hail) with different elections. Create rate sheets to view calculations for a range of yields across multiple coverage levels.

Optionally include policy history for more accurate quoting.

Build comparisons that are independent of a grower’s policy history or—for more accurate, detailed estimates—use the grower’s previous or current year policy details to calculate premium.

Print, Save and Download Premium summaries to review with growers.

Share comparisons and quotes with growers with helpful aggregated or detailed printouts. Create these estimates and printouts for a single grower or a batch of growers with similar policy details.

Quote more than just row crops.

Not limited to just row crop support as the Estimator been tailored for specialized commodities, plans and productions, including Whole-Farm Revenue Protection (WFRP), Nursery, Fruit and Tree Dollar Plans and Livestock Risk Protection (LRP). Quickly create five-, ten- or fifteen-year loss lookbacks on Pasture Rangeland Forage (PRF) or Annual Forage(AF) plans as well.

Compare & save.

Compare rates for multiple providers to ensure adequate coverage for growers while still receiving the lowest rate by commodity, township, form code and endorsements.

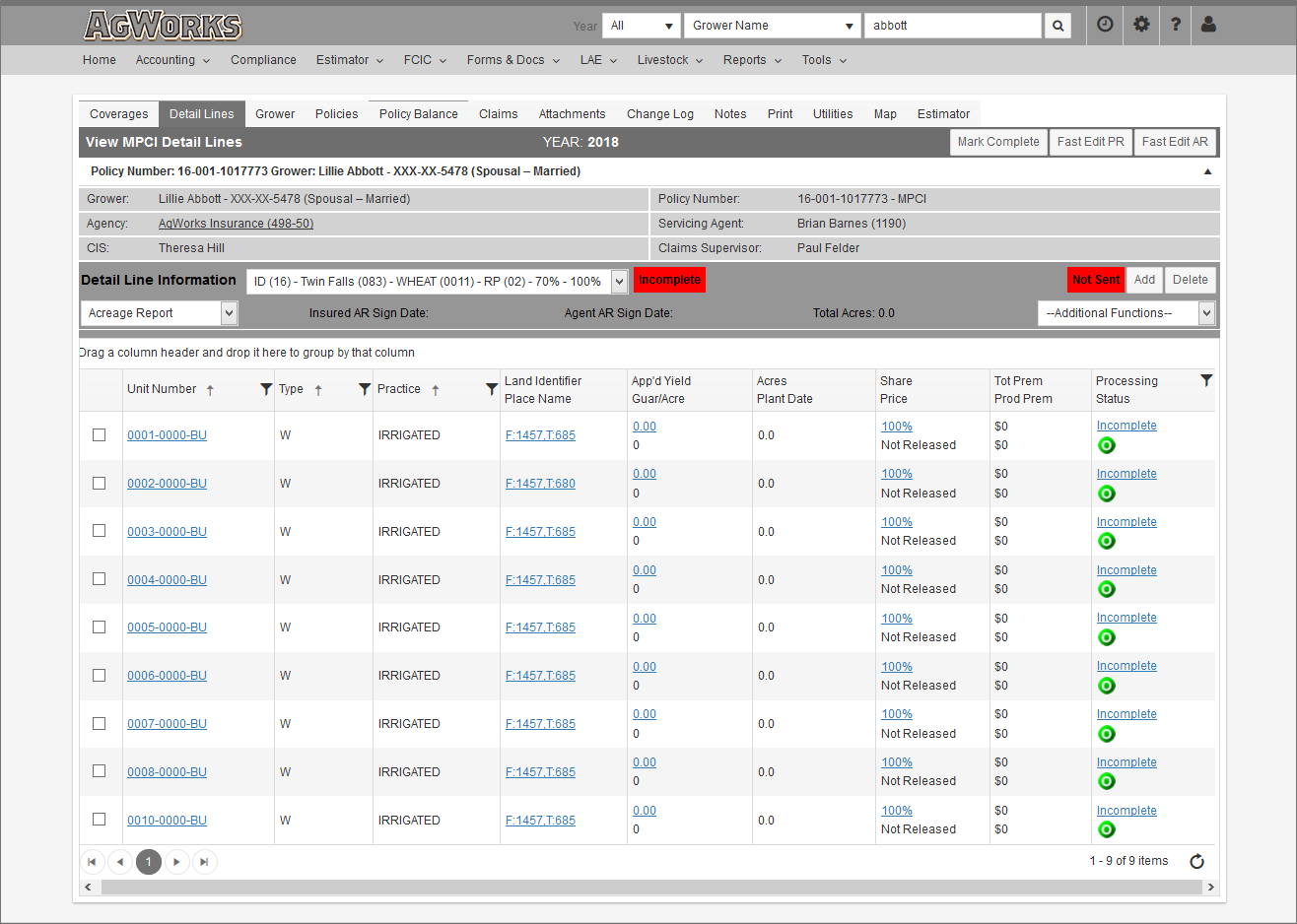

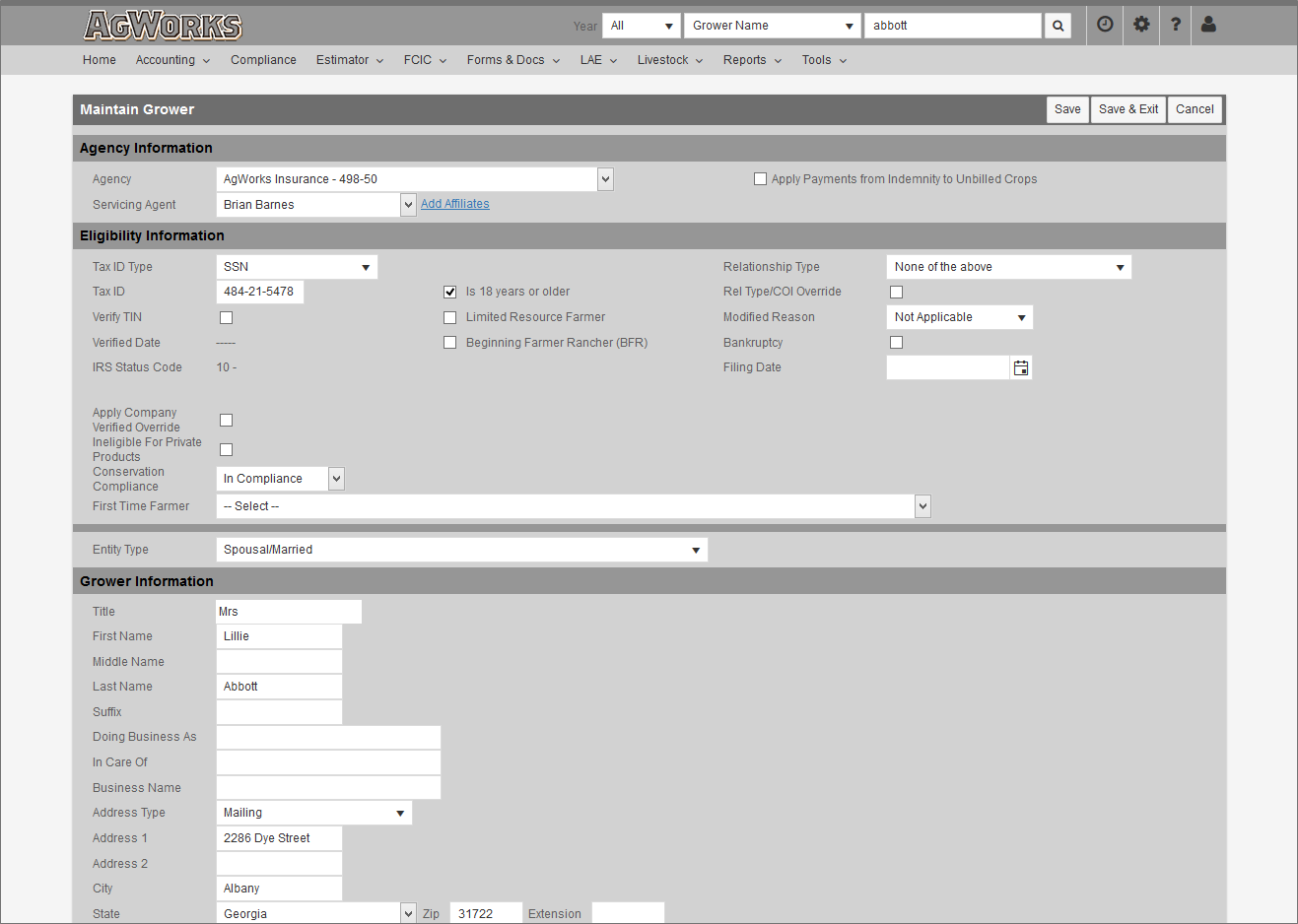

Overview

Within the AgWorks Application Framework, policies are broken down into the different components used to manage attributes of a policyholder and policy details—documenting details related to insurable field groupings, entering prior production history and recording acreage and plant dates on a field-by-field basis just to name a few.

Features

Manage policy details.

The AgWorks Application Framework allows for the documentation of details related to insurable field groupings, the entry of prior production history, and the recording of acreage and plant dates on a field-by-field basis just to name a few.

Control user access according to their responsibilities.

To secure the system, access to policy functions is restricted by the user type (e.g., policyholder, agent, company underwriter, or claim supervisor), and additionally, many functions are controlled by the calendar (e.g., certain policy details cannot be altered after sales closing).

View Production History records.

US crop insurance coverage is often driven by a policyholder’s prior production history. Production and acres are used to calculate an average yield that impacts production guarantees and rating structure. The records are retained in the system.

Overview

AgWorks provides a suite of reports, across multiple business products, to improve processing efficiency and company reporting.

Features

Analyze data quickly with our data warehouse .

To provide quick, accurate reporting and data analysis, AgWorks utilizes a data warehouse for reporting-centralizing policy data, minimizing strains on system performance and increasing business efficiency.

Schedule your data captures.

Customize the frequency of data captures to meet your reporting needs and track historical trends.

Create a heat map.

Create a visual representation of data values across multiple states or counties.

Overview

Most forms created within the AgWorks Application Framework include QR codes. A QR code, or quick response code, is a machine-readable barcode that contains information about the item it’s printed on (e.g., the grower, policy number, document type). As such, forms with these QR codes can be scanned, read by the system, and automatically attached to the policies they are related to—saving valuable time for users.

Features

Auto-attach scanned documents to policies.

Automatically upload multiple policyholder documents to their respective records through batch scanning to save time and increase processing speed.

Identify missing information to quickly complete records.

Easily isolate any documents that did not attach or that have missing pages so records can be tracked down and added in a timely manner.

Overview

An Integrated Mapping Module is available within the AgWorks Application Framework for simple, fast, accurate reporting. The module is tied to the policyholder’s record so agents can better assist policyholders in planning and managing their fields. Having an accurate map of a policyholder’s fields simplifies complicated insurance reporting and eliminates mistakes.

Features

Quickly identify and map fields for a grower’s operation using multiple data sources.

The module integrates with FSA CIMS data to identify the Farm/Tracts in the grower’s operation. Query and display the Common Land Unit layer to identify all fields for the grower. Verify the accuracy of field boundaries with our high-resolution imagery. Other data can also be integrated and displayed on the maps such as soils, weather and topography.

Automap for fast field creation.

The Integrated Mapping Module can automatically identify and create fields from FSA information (via CIMS or ACRSI) or from the land identifiers on the policy. The land identifiers and legals (i.e., Farm, Tract, Section, Township, County) are all automatically determined for every field.

A robust suite of field editing tools also allows you to create, modify, split and update boundaries—even add irrigation pivot boundaries. The tools also import field boundaries from GPS or other mapping systems.

Generate a variety of maps and forms.

Print a variety of maps such as Mapbooks, map-based acreage reports and SOIs as industry-standard PDF documents. These maps can also include aerial imagery and user-created labels. The module can generate map booklets with record keeping sheets for the grower as well as a Map Based Acreage Report and Schedule of Insurance. It also allows for the printing of wall maps.

Integrate with a policy for efficient processing.

Add crop and planting information to the field and the module will automatically determine the applicable insurance unit. Use the map information to update the acreage report data on the policy and attach applicable CLU information where needed to meet RMA reporting field reporting requirements.

Interface with other systems.

The Mapping module can import planting information from third-party Precision Ag Applications via APIs. Other data sources, such as weather and imagery, can also be added with APIs.

Overview

Our claim systems are highly customized by crop and product and incorporate comprehensive data validation, training and licensing requirements, and approval limits. The claims system is fully integrated with our field adjuster systems and include many reports used to manage adjuster assignments and claims workload. Integration with our compliance module ensures internal compliance reviews have been completed for all high dollar claims before checks can be issued and paid. Claims are typically processed within a payment structure.

Features

Manage claim details.

Within the AgWorks Application Framework, claims can be modified and worked by different employee types. Agents can create Notices of Loss, check the status of claims, view signed claim documents attached to the claim and print multiple forms using the claim data. Adjusters and Claims Processors can edit all applicable details of a claim as well as work, process and submit the claim for payment.

Track and complete actions from a single access point.

Our claims and inspections register provides a single access point for tracking claims and inspections as well as completing quick actions (e.g., add a note, assign to an adjuster) on multiple claims and inspections at a time.

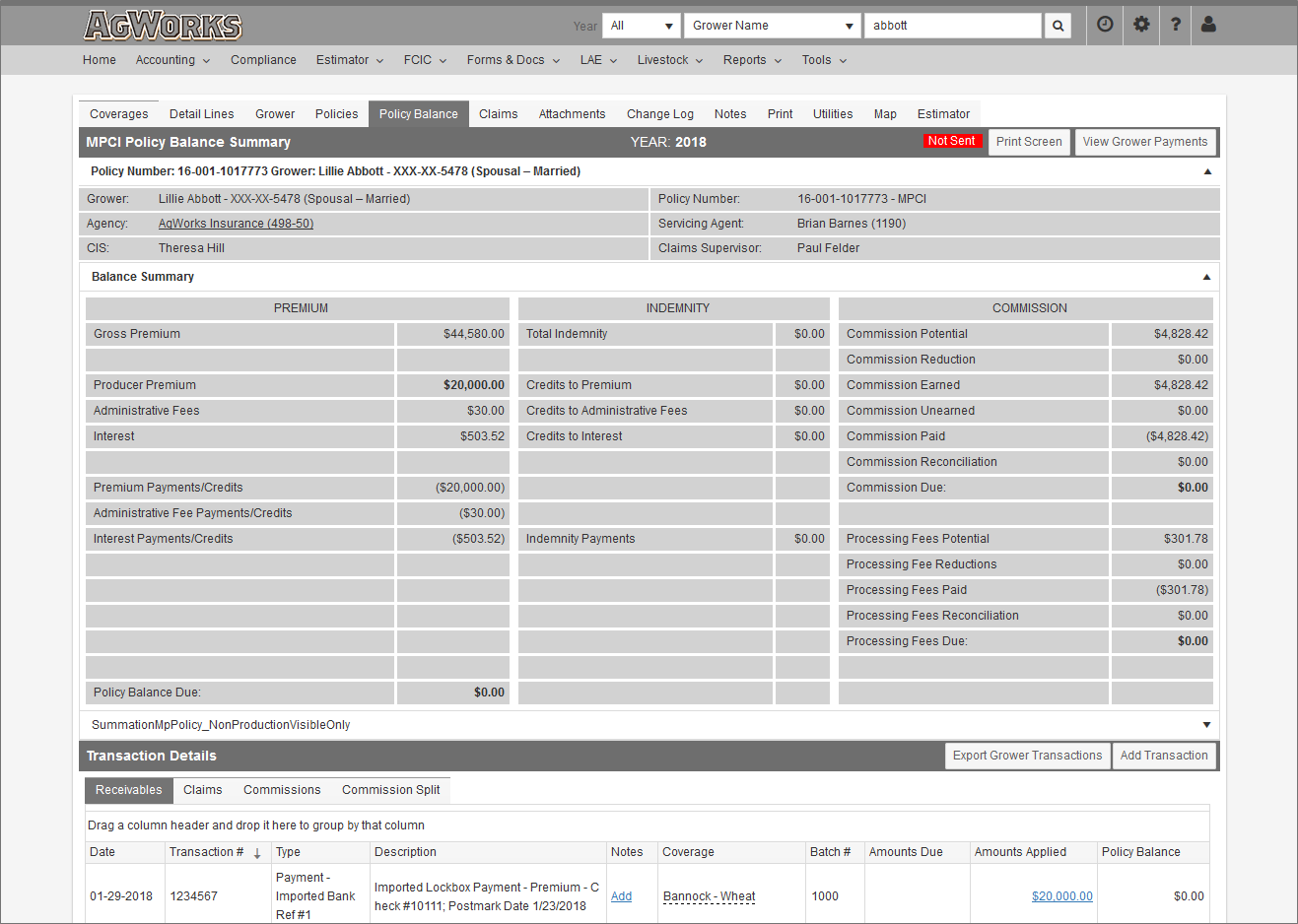

Overview

Accounting is a complex, integral component in any crop insurance system. Contributing to these complexities are RMA regulations, multiple billing dates, intricate commission/profit share/processing fee calculations, and payment agreements as well as 1099s, ITS, and grower payment processing. We have developed a system that accurately and efficiently accommodates each of these processing areas and further, provides supporting documentation and detailed reports and exports which are available for appropriate data sharing, whether it be for customers, agencies, RMA, or audit purposes. In addition, our Accounting module offers Loss Adjuster Expense (LAE) payments and tracking functionality. Our LAE system provides for both payment to adjusters as well as allocation of costs to a claim.

Features

In-System Accounts Payable and Accounts Receivable processing.

Create billing statements for growers using their policy data in the System, generate agency commissions using policy data, create payment plans for growers and more using the accounting module.

Create and generate 1099s.

For tax season, the accounting module supports the management and generation of 1099s for claims, commissions and expense reimbursement payments made from the System.

Pay and track loss adjuster expenses.

With our Loss Adjuster Expense (LAE) functionality, expenses from adjusters in the field can be entered and tracked for payment to adjuster and allocated to a claim.